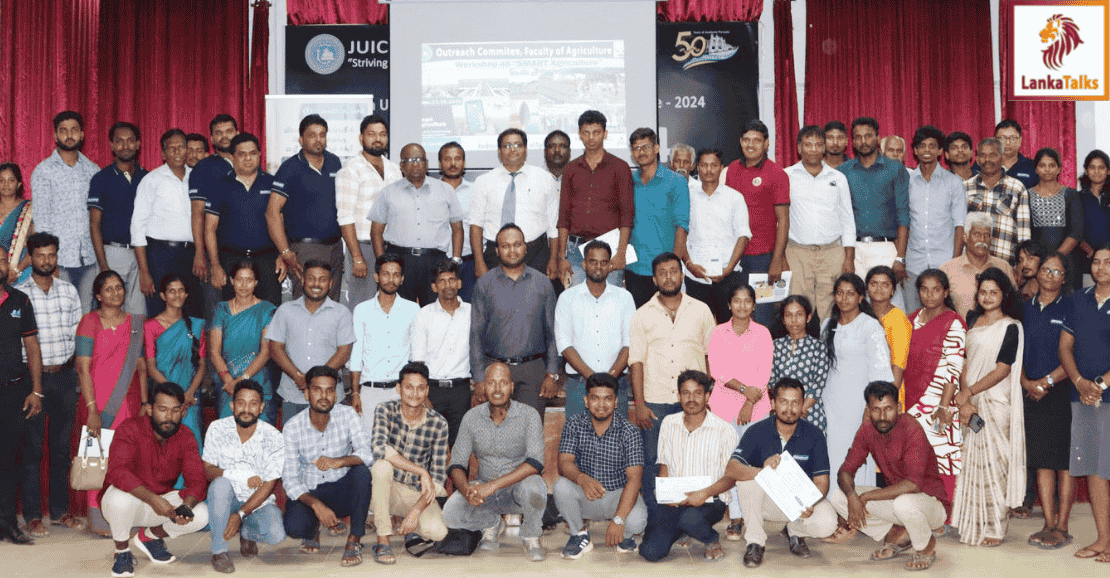

Full day hands on workshop benefits 100 farmers in Kilinochchi

The Commercial Bank of Ceylon has partnered with the Faculty of Agriculture of the University of Jaffna to deliver hands-on training in smart farming technologies to 100 farmers in Kilinochchi in a significant move to modernise Sri Lanka’s agriculture and strengthen food security in the face of climate change.

A full-day workshop was held at the University’s greenhouses and demonstration fields under the banner of the Bank’s ‘Agri Modernisation Village’ programme. It brought together farmers, youth, agriculture students, and instructors to explore practical, environmentally sustainable methods that address the challenges posed by erratic weather patterns, pest outbreaks, and reduced crop yields.

Participants engaged directly with climate-smart innovations including compost choppers, drought-resistant crop varieties, efficient irrigation systems, and renewable energy-powered tools. The workshop placed special emphasis on youth empowerment, aiming to cultivate a new generation of agri-entrepreneurs equipped with both the mindset and the means to transform farming into a modern, technology-driven, and profitable enterprise.

The training was coordinated by the University’s Outreach Committee, which facilitated the knowledge transfer using its automated greenhouses, farm units, and farmer-maintained demonstration fields in Kilinochchi. Commercial Bank supported the initiative financially and facilitated the participation of its agricultural loan customers, ensuring that farmers could gain exposure to technologies that may be adopted with the help of tailored financial solutions from the Bank.

This latest intervention builds on the Bank’s growing footprint in agri-modernisation and reflects its broader commitment to sustainable development, rural economic upliftment, and environmental stewardship. Through such initiatives, the Bank said it aims not only to enhance the productivity and resilience of its farmer clients but also to reduce credit risk and promote long-term economic stability across Sri Lanka’s agricultural communities.

What sets this programme apart is its practical field-based learning, strong collaboration between academia, the financial sector, and grassroots farmers, and its strategic alignment with national climate adaptation goals. The workshop forms part of an evolving model that links hands-on knowledge, real-world technology, and financial accessibility – all essential ingredients for revitalising rural agriculture.

This effort is also embedded in a larger vision of Commercial Bank: to create Agri Modernisation Villages across the country that showcase replicable models of sustainable farming. Through training, demonstrations, and partnerships with universities, the Bank said it envisions a nationwide transformation of agriculture that will help address food insecurity, rising costs, and declining farmer incomes.

Commercial Bank’s involvement ensures that participants not only receive cutting-edge technical guidance but are also supported to make informed investments in the tools and methods they experience first-hand. The programme is especially focused on bringing young people into the fold, positioning farming as a career of opportunity and innovation rather than one of hardship and uncertainty, the Bank said.

This programme in Kilinochchi follows similar recent interventions in Batticaloa and Welimada and strengthens Commercial Bank’s position as the only private bank in Sri Lanka actively leading agricultural transformation through public–private–academic partnerships.

Commercial Bank is the first Sri Lankan bank to be listed among the Top 1000 Banks of the World and has the highest market capitalisation in the banking sector in the Colombo Stock Exchange (CSE). The Bank is the largest private sector lender, the largest lender to the SME sector, is a leader in digital innovation and is Sri Lanka’s first 100% carbon-neutral bank.

Commercial Bank operates a strategically located network of branches and automated machines island-wide, and has the widest international footprint among Sri Lankan banks, with 20 outlets in Bangladesh, a fully-fledged Tier I Bank with a majority stake in the Maldives, and a Microfinance company in Myanmar. The Bank recently opened a representative office within the Dubai International Financial Centre (DIFC), taking a significant step towards broadening its global footprint. The Bank’s fully-owned subsidiary CBC Finance Ltd., also delivers a range of financial services via its own branch network.

Natasha

Natasha