Coconut production sustained its growth momentum, recording a notable year-on-year increase in November 2025 and achieving a positive growth during January to November. However, this growth also reflects the base effect following the sharp production decline in 2024, Central Bank’s recent Weekly Economic Indicators report said.

The report said during January to November 2025, tea production recorded a marginal year-on-year increase, though a decline in production was recorded in November 2025. According to provisional data, rubber production declined in November due to heavy rainfall disrupting tapping operations and also recorded a decline during January to November 2025.

The Weekly Average Weighted Prime Lending Rate (AWPR) for the week ending January 16 2026 decreased by 21 bps to 8.98 per cent compared to the previous week. The Average Weighted Call Money Rate (AWCMR) was 7.94 per cent on January 16, 2026 compared to 7.96 per cent at the end of last week.

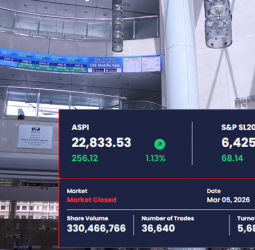

The reserve money increased compared to the previous week mainly due to the increase in currency in circulation and the increase in deposits held by the commercial banks with the Central Bank. The total outstanding market liquidity was a surplus of Rs. 160.19 billion by January 16, 2026, compared to a surplus of Rs. 171.03 bn by the end of last week. By January 16 2026, the All-Share Price Index (ASPI) increased by 0.33 per cent to 23,731.60 points and the S&P SL 20 Index increased by 0.88 per cent to 6,560.08 points, compared to the index values of last week.

During the week, T-Bill and T-Bond yield rates remained broadly stable except for a small increase observed in the T-Bills. The rupee value of T-Bills and T-Bonds held by foreign investors decreased by approximately 1 per cent compared to the previous week. In the reporting week, the auction for T-Bills experienced an oversubscription rate of approximately 3.5 times and T-Bonds experienced an oversubscription rate of approximately 1.9 times. The total volume of secondary market transactions in T-Bills and T-Bonds decreased by approximately 20.9 per cent in the reporting week compared to the week before. (MFJ)

Source: Daily News

Natasha

Natasha