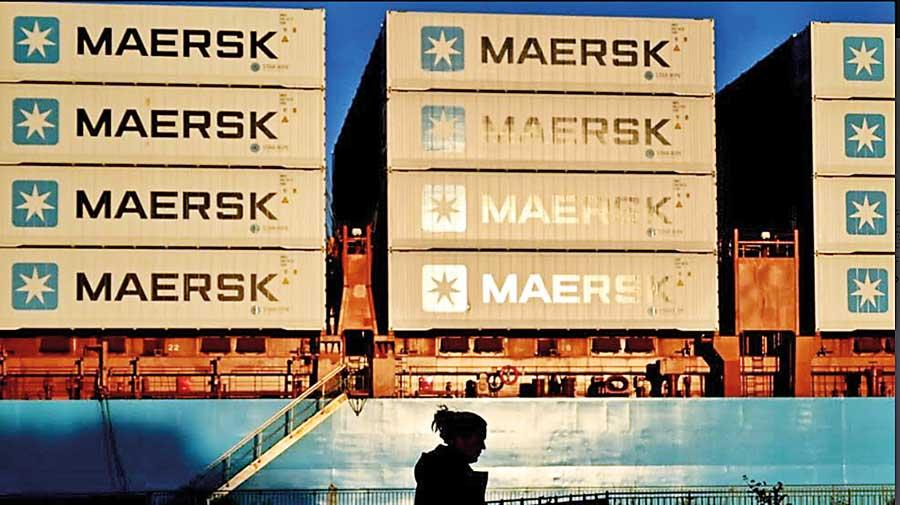

Shares in shipping giant Maersk dived on Thursday after it warned of an uncertain 2024 earnings outlook linked to an oversupply of container vessels and Yemeni rebel attacks in the Red Sea.The downbeat forecast came after its 2023 earnings were hit by overcapacity in the shipping sector, which caused a drop in freight rates.The group reported a more than sevenfold drop in its net profit last year to US $ 3.8 billion, compared to US $ 29.2 billion in 2022. Its revenue reached US $ 51 billion compared to US $ 81.5 billion the previous year.

Freight rates had soared in 2022, due to capacity shortages amid high demand following the end of Covid pandemic restrictions.“The high demand eventually started to normalise as congestions eased and consumer demand declined leading to an inventory overhang,” Maersk said in its earnings report.This “correction” resulted “in rapid and steep declines in shipped volumes and rates” starting at the end of the third quarter of 2022, it added.The “oversupply challenges” in the maritime shipping industry are expected to “materialise fully” over the course of 2024, Maersk said.

Chairman Robert Maersk Uggla and CEO Vincent Clerc said in the earnings report that “2023 ended with multiple distressing attacks on cargo ships in the Red Sea and the Gulf of Aden”.They noted that two of the company’s ships had been targeted.“We are horrified by the escalation of this unfortunate conflict,” they said.Maersk and other shipping companies have redirected ships away from the Red Sea, taking the longer and costlier route around the southern tip of Africa. The Red Sea usually carries about 12 percent of global maritime trade.Maersk reported a loss of US $ 456 million in the last three months of 2023, with sales dropping 34 percent to US $ 17.8 billion compared to the same period in 2022.In a separate statement, Clerc said, “While the Red Sea crisis has caused immediate capacity constraints and a temporary increase in rates, eventually the oversupply in shipping capacity will lead to price pressure and impact our results.”Maersk also announced it would spin off its towage business, Svitzer, as a separate listed company.

( Source : Daily Mirror)

Abishek

Abishek