The Commercial Bank of Ceylon has announced plans to raise up to Rs 15 billion for lending to sustainability-linked projects via a Green Bond approved in principle by the Colombo Stock Exchange (CSE) for public listing.

The Green Bond Issue opening on Monday 4th August 2025 will comprise of an initial issue of 100 million Basel III Compliant - Tier 2 Listed Rated Unsecured Subordinated Redeemable Green Bonds with a Non-Viability Conversion feature, at the par value of Rs 100/= each, to raise a sum of Rupees 10 billion; and an option to issue up to a further 50 million Green Bonds at the discretion of the Bank, in the event of an oversubscription of the initial issue.

The Bank said the issue will further strengthen its Tier II capital base and raise funds for the expansion of its green lending portfolio.

Limited to Qualified Investors, the Green Bonds will be offered in six types with three tenures – Types A and B with a five-year tenure, Types C and D with a seven-year tenure, and Types E and F with a 10-year tenure, the Bank said.

Type A will carry a fixed interest rate of 10.55% p.a. (AER 10.83%) payable semi-annually; Type B 10.85% p.a. (AER 10.85%) payable annually; Type C 10.85% p.a. (AER 11.14%) payable semi-annually; Type D 11.15% p.a. (AER 11.15%) payable annually; Type E 11.00% p.a. (AER 11.30%) payable semi-annually; and Type F 11.30% p.a. (AER 11.30%) payable annually.

The minimum subscription per application for an individual Qualified Investor is set at Rs 5 million, while the minimum subscription per application for other Qualified Investors is Rs 10,000/- or 100 Green Bonds.

The Green Bonds are rated A (lka) by Fitch Ratings Lanka Limited. The Investment Banking Division of Commercial Bank of Ceylon PLC is the Manager to the Issue.

More details of the Green Bond Issue can be obtained from the application form and prospectus on the Bank’s website www.combank.lk and the Colombo Stock Exchange’s website www.cse.lk and are available with Trading Participants of the CSE. The Bank said applications can be handed over at any Commercial Bank branch.

For the three months ending 31st March 2025, the Commercial Bank Group reported gross income of Rs 88.105 billion, total operating income of Rs 46.619 billion, profit before tax of Rs 22.557 billion and profit after tax of Rs 14.972 billion, with total assets reaching Rs 2.999 trillion, loans and advances totalling Rs 1.642 trillion and total deposits exceeding Rs 2.412 trillion.

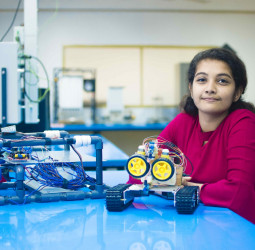

Photo caption: One of many Green projects funded by Commercial Bank via the Bank's Green Lending programme.

A.R.B.J Rajapaksha

A.R.B.J Rajapaksha