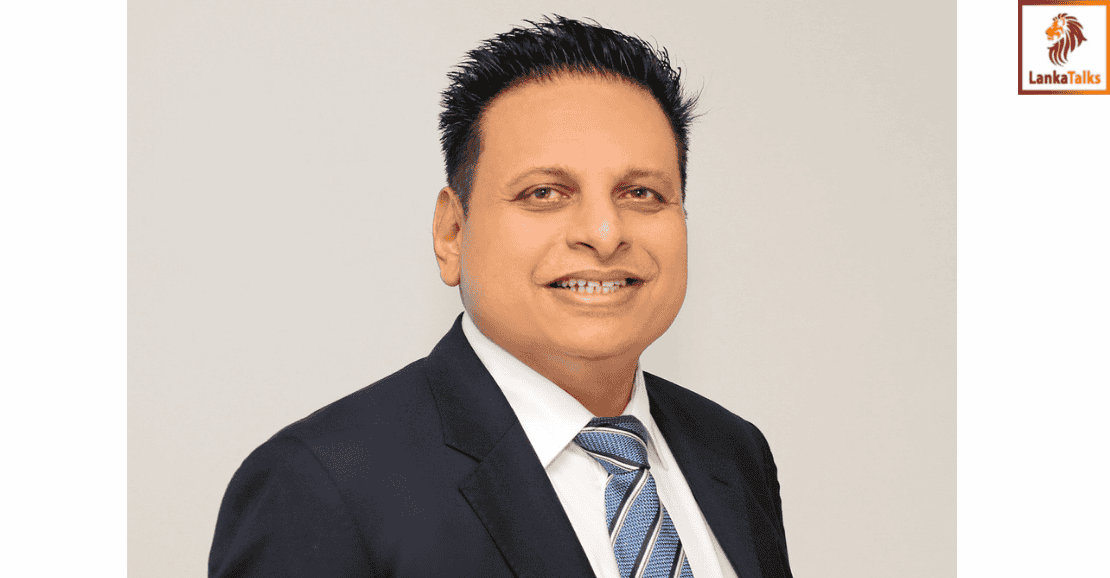

Seylan Bank PLC announced the appointment of Ranil Dissanayake as its new Chief Operating Officer (COO). Having begun his banking career with Seylan Bank, Dissanayake brings over 35 years of experience in banking leadership, strategy, and operational excellence to the role.

Dissanayake’s career spans significant milestones across Branch Banking, Corporate Banking, and SME development. He began his journey managing several of Seylan’s key metropolitan branches, including the flagship Millennium Branch, where he drove consistent growth and service excellence. Rising through the ranks, he went on to serve as Regional Manager for both suburban and metropolitan networks, and later as Zonal Head, overseeing a large branch footprint with a focus on strategic expansion and enhanced service delivery.

His expertise in SME banking has been a defining strength throughout his career. As Assistant General Manager – SME, and Associate Member of the Institute of Bankers of Sri Lanka, he worked closely with global consultants such as the Boston Consulting Group (BCG) to implement structural reforms that enhanced SME lending and processing efficiency. In his most recent role as Deputy General Manager – Branch Credit, Dissanayake oversaw lending operations across the SME sector, aligning credit growth with the Bank’s strategic objectives while upholding risk and portfolio quality standards.

In addition to branch and SME leadership, Dissanayake has played a key role in guiding strategic business units. These include the Bank’s Islamic Banking division, the Credit Monitoring Unit, Margin Trading and Factoring services, Centralized Credit Units and Regional Hubs, as well as the SME Business Development Unit. His contributions have extended beyond operations to spearheading market research, product development, customer acquisition, and industry networking through SME-focused initiatives.

As a Key Management Personnel (KMP), Dissanayake has been instrumental in shaping Seylan Bank’s corporate strategy. His leadership has consistently emphasized financial inclusion, sustainable credit growth, and innovation in banking services. His extensive experience across diverse banking functions positions him well to lead the Bank’s operations into its next phase of growth.

Natasha

Natasha