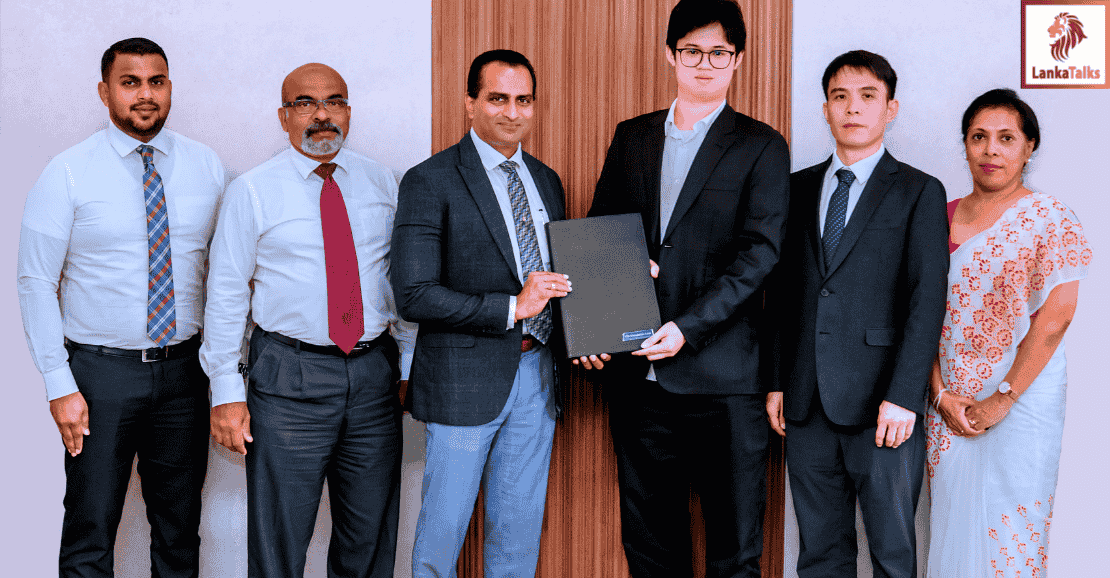

Enters into MoU with developer Baili Investments Lanka to support sales at 1000-unit high rise

In yet another demonstration of its understanding of customer requirements, the Commercial Bank of Ceylon has entered into a Memorandum of Understanding (MoU) with Baili Investments Lanka Private Ltd. to provide prospective buyers of condominium apartments at a mixed development project in Rajagiriya with access to flexible home loan facilities.

Under this agreement, the Bank will offer home loans to buyers through tripartite arrangements involving the Bank, the developer, and the buyer. Buyers will be able to obtain loans covering up to 75% of the purchase price of their apartments, making it significantly easier for them to own homes in this landmark development.

The project represents an investment of US$ 60 million by Baili Investments Lanka featuring six modern towers with 1,000 luxury apartment units, a shopping complex, cinema and premium lifestyle amenities. The project aims to enhance urban living and aligns with Sri Lanka’s Megapolis and Western Development vision. Construction commenced in May 2023 and the superstructure has already reached the sixth floor. Presales are currently underway, with the full project expected to be completed in September 2029

Located in Rajagiriya, the development offers a unique blend of urban convenience and a tranquil, green environment, positioning it as one of the most desirable residential projects in Colombo’s suburbs.

Through this partnership, Commercial Bank aims to expand its housing loan portfolio by providing facilities at the lowest interest rates in the market, with repayment plans that include grace periods of up to five years, and structured and tailor-made payment plans. These concessions will enable customers to plan their financial commitments with greater flexibility and confidence. On top of these, the Bank will offer a free Decreasing Term Assurance Policy (DTAP) or a loan protection policy for first time home buyers, covering the life of the buyer to settle the Home Loan through the insurance policy, in case of an unforeseen eventuality.

The Bank said the agreement between Commercial Bank and Baili Investments Lanka not only opens the door for Sri Lankans to secure modern luxury homes but also underlines the Bank’s commitment to supporting quality real estate developments backed by reputed international investors.

Baili Investments Lanka is a BOI-registered Sri Lankan real estate developer backed by Hong Kong investor Mr Tristan Wu, who has over 20 years of multi-sector experience and a proven track record of successful property development ventures in China. The high-rise in Rajagiriya is the company’s first project in Sri Lanka.

The first Sri Lankan bank with a market capitalisation of more than US$ 1 billion, Commercial Bank was also the first bank in the country be listed among the Top 1000 banks of the world, and has the highest capital base among all Sri Lankan banks. The Bank is the largest private sector lender in Sri Lanka and the largest lender to the country’s SME sector. Commercial Bank is also a leader in digital innovation and is Sri Lanka’s first 100% carbon-neutral bank.

Commercial Bank operates a network of strategically located branches and automated machines island-wide, and has the widest international footprint among Sri Lankan banks, with 20 branches in Bangladesh, a fully-fledged Tier I Bank with a majority stake in the Maldives, a Microfinance company in Myanmar and a representative office in the Dubai International Financial Centre (DIFC). The Bank’s fully owned subsidiaries, CBC Finance Ltd. and Commercial Insurance Brokers (Pvt) Limited, also deliver a range of financial services via their own branch networks.

Natasha

Natasha