The Commercial Bank of Ceylon has partnered with Hayleys Agriculture to offer customised leasing and loan facilities to farmers investing in high-quality agricultural machinery supplied by Hayleys Agriculture, in a move designed to strengthen Sri Lanka’s vital agriculture sector through affordable access to modern equipment.

Under this partnership, farmers purchasing tractors, harvesters and other agricultural equipment from Hayleys Agriculture will be eligible for special Agri Leases and Diribala Green Development Loans from Commercial Bank. These facilities come with flexible repayment terms aligned with cropping cycles, preferential interest rates, and speedy processing, reducing the financial burden on farming communities while promoting mechanisation and productivity.

The initiative is expected to significantly ease the capital constraints faced by farmers, enabling them to upgrade from labour-intensive traditional methods to efficient, technology-driven practices. This in turn is anticipated to boost crop yields, reduce operational costs and support food security objectives at both national and regional levels, the Bank said.

Commercial Bank’s financing products offered under this partnership are available to both individual farmers and agribusinesses and cover a wide range of equipment categories marketed by Hayleys Agriculture – a pioneer and market leader in the agri-input and machinery segments in Sri Lanka.

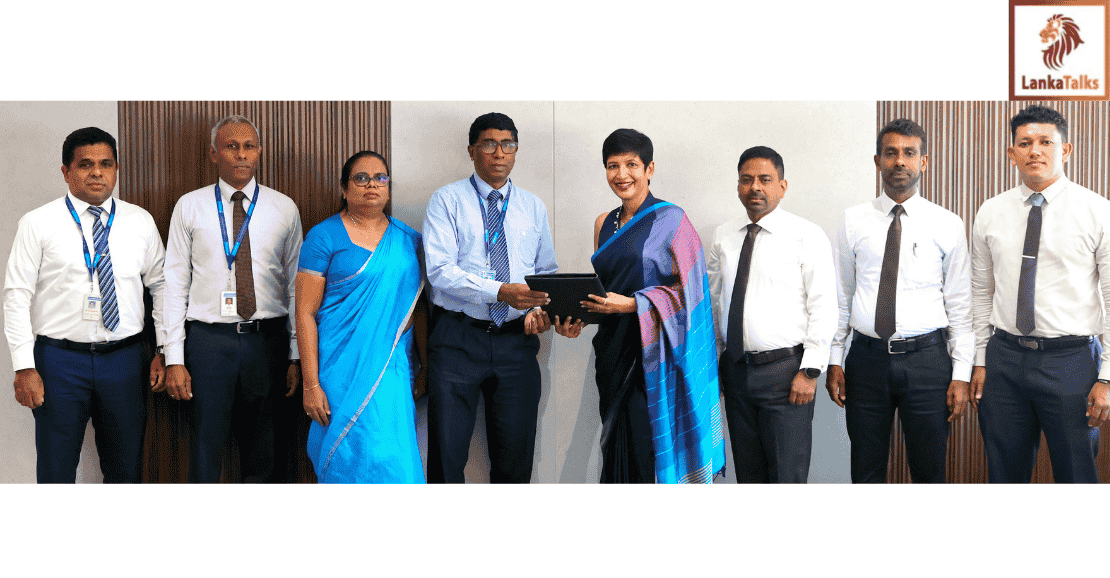

Commenting on the partnership, Commercial Bank’s Deputy General Manager – Personal Banking Mr S. Ganeshan said: “This collaboration with Hayleys Agriculture reflects our commitment to strengthening rural livelihoods and ensuring sustainability in the agriculture sector. We recognise that upgrading agricultural infrastructure is key to unlocking growth and resilience in this segment.”

The Managing Director of Hayleys Agriculture Holdings Ltd., Ms. Jayanthi Dharmasena noted: “Hayleys Agriculture has always sought to empower the farming community through innovation and access. By working with a trusted financial partner like Commercial Bank, we are making advanced mechanisation more accessible and affordable.”

The rationale for this initiative stems from the shared recognition by both entities that low mechanisation levels and limited credit access remain critical challenges for Sri Lanka’s farmers. By linking access to advanced technology with inclusive financing solutions, the programme aims to uplift farming communities and foster a more competitive and sustainable agricultural landscape.

This collaboration also aligns with Commercial Bank’s broader sustainability agenda and Green Financing strategy, which prioritises investments that reduce environmental impact and promote responsible resource use.

Commercial Bank is the first Sri Lankan bank to be listed among the Top 1000 Banks of the World and has the highest market capitalization in the Banking Sector in the Colombo Stock Exchange (CSE). The Bank is the largest private sector lender, the largest lender to the SME sector, is a leader in digital innovation and is Sri Lanka’s first 100% carbon-neutral bank.

Commercial Bank operates a strategically located network of branches and automated machines island-wide, and has the widest international footprint among Sri Lankan banks, with 20 outlets in Bangladesh, a fully-fledged Tier I Bank with a majority stake in the Maldives, and a Microfinance company in Myanmar. The Bank recently opened a representative office within the Dubai International Financial Centre (DIFC), taking a significant step towards broadening its global footprint. The Bank’s fully-owned subsidiary CBC Finance Ltd., also delivers a range of financial services via its own branch network.

Natasha

Natasha